BOOTCAMP Market and CPD Risk

" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen>

MARKET AND COUNTERPARTY CAPITAL [175 HOURS]

| Sln | Topic | Details | ||

| Module 1 - Risk Foundation | ||||

| 01 | Coding in Python |

Data types, CRUD operations If Else Statements & Loops Numpy, Pandas, Matplotlib Regression & Time Series in Python Monte Carlo Simulations in Python |

||

| 02 |

y = f(x) thinking (Excel + Python) |

Taylor Series Sensitivity based approaches Option Greeks |

||

| 03 |

Risk Metrics (Excel + Python) |

Formulating VaR & ES (Parametric, Historical, Monte Carlo) Calculation of VaR & ES for simple instruments (EQ, IR, Fx, Commodity) |

||

| Module 2 – Risk Aggregation | ||||

| 04 |

Portfolio Mapping (Excel + Python) |

Systematic VaR Specific VaR Factor Models & PCA |

||

| 05 |

Risk Mapping & Aggregation (Excel + Python) |

Bond Portfolio Stock Portfolio Option Portfolio |

||

| Module 3 – FRTB Model | ||||

| 06 |

Standardised Approach (Excel + Python) |

Delta, Vega, Curvature Charge Residual Risk add-on Default Risk Charge |

||

| 07 |

Advanced Approach (Excel + Python) |

Expected Shortfall Calibrations with stressed periods NMRF Stress Capital Default Risk Charge |

||

| 08 |

PnL Attribution & Backtesting (Excel + Python) |

PL Attribution Tests Backtesting |

||

| 09 |

Model Validation (Excel + Python) |

Common checks in model validation Review of SR 11-7 Case studies from past |

||

| Module 4 – Counterparty Credit Risk | ||||

| 10 |

Exposure Modelling (Excel + Python) |

EE, EPE, EEPE in Python Forwards (EQ, IR, Fx) Swaps (IRS, CCS) Options (EQ, Caplets) |

||

| 11 |

EAD Modelling (Excel + Python) |

Standardised Approach - CCR Internal Models Method |

||

| 12 |

CVA Capital Charge (Excel + Python) |

Standardised Approach Advanced Approach |

||

| 13 |

XVA toolbox (Excel + Python) |

End to end project in python calculating BCVA, FVA, ColVA, MVA, KVA |

||

ABOUT THE TRAINER

Satya is an IIT and IIM alumni with 8+ years of total work experience spanning across Financial Risk consulting and project management and strategy. Worked as SME and Lead in Various finance, risk, regulatory engagements and complex data migraflon project. Adept in BASEL, FRTB capital calculations, model development and machine learning.

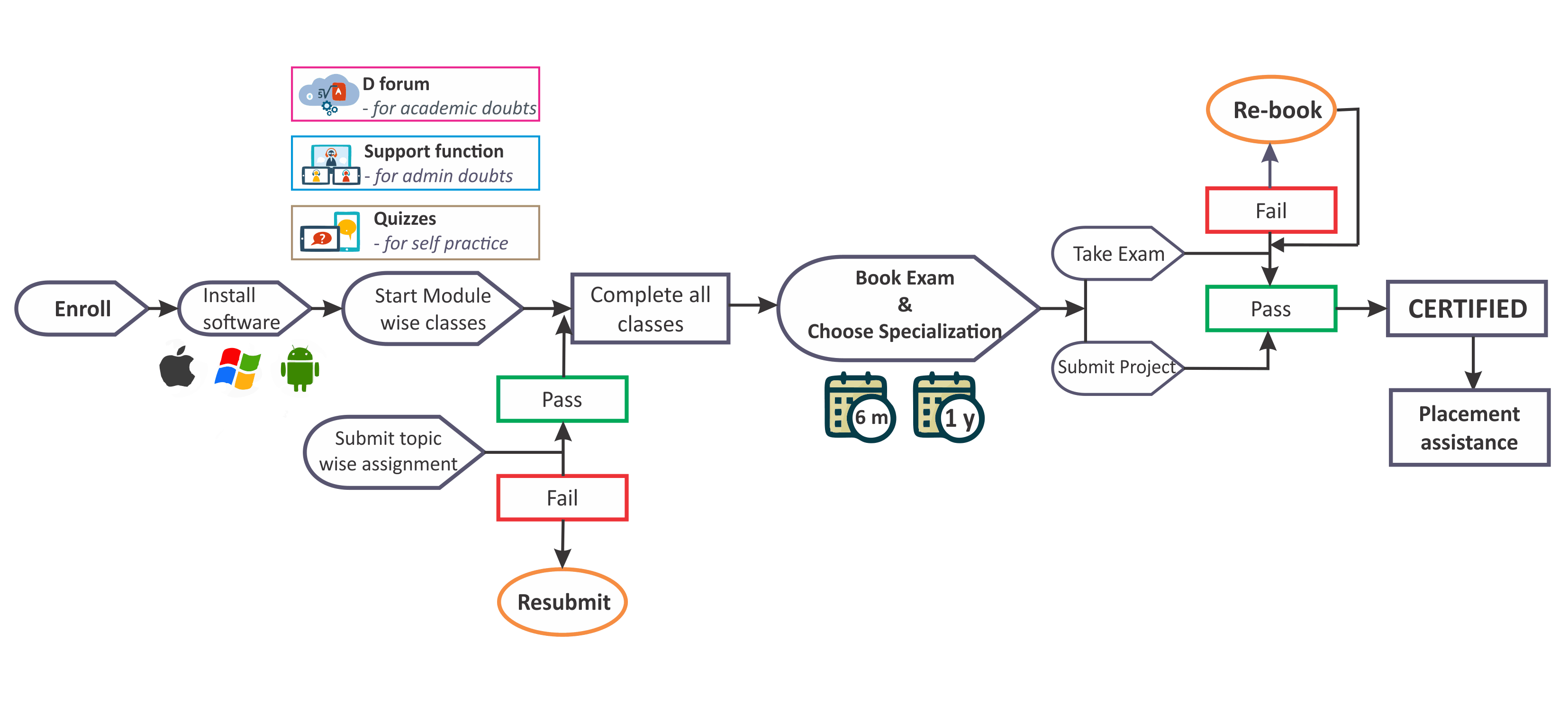

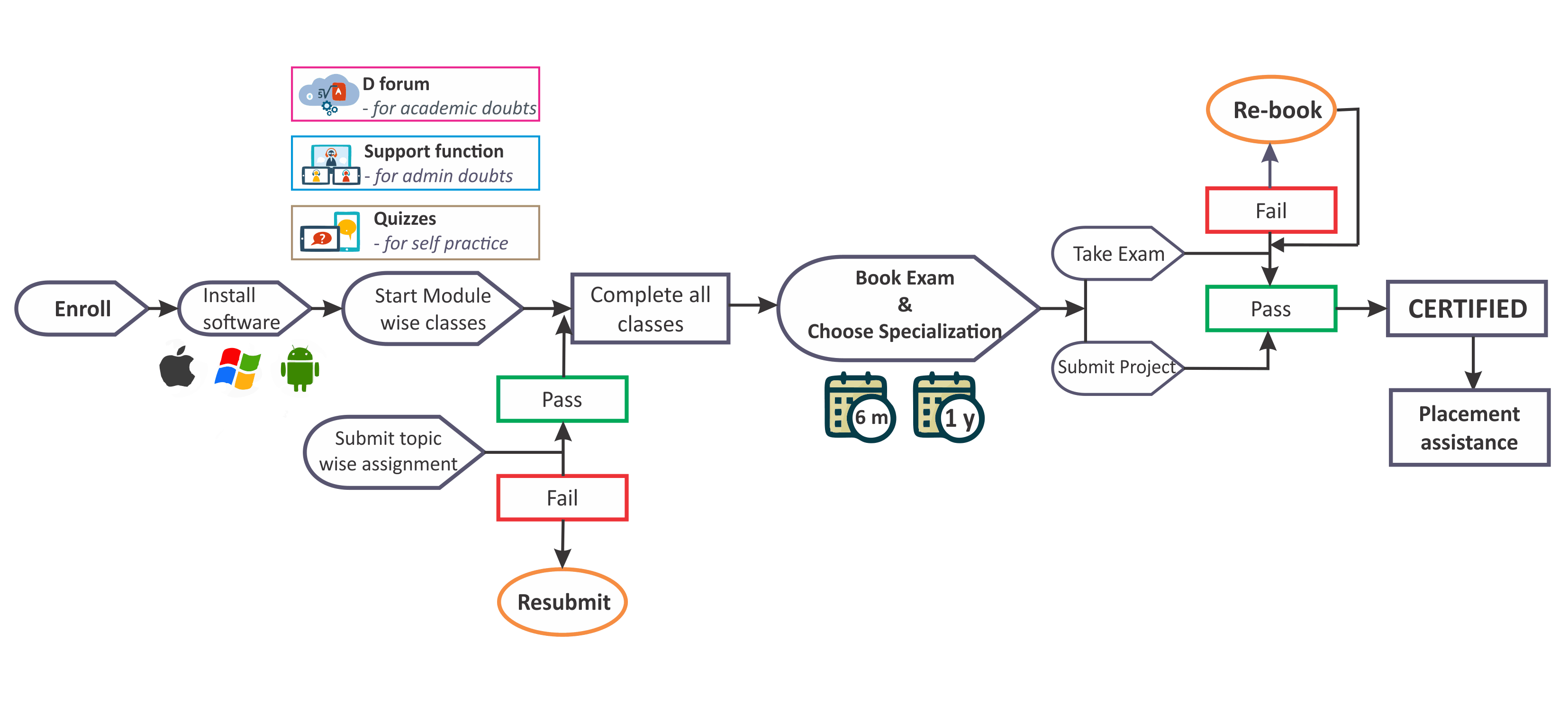

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Market risk and counterparty capital charge program focuses on regulatory specific modelling and doesn't require advanced level of math's. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies, spreadsheet models & python codes. The approach of delivering the concepts is application based to make you a right fit for market risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone. We don't allow connecting multiple monitors to laptop.

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheet, python files and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is virtually delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.

" frameborder="0" allow="accelerometer; autoplay; clipboard-write; encrypted-media; gyroscope; picture-in-picture" allowfullscreen>

MARKET AND COUNTERPARTY CAPITAL [175 HOURS]

| Sln | Topic | Details | ||

| Module 1 - Risk Foundation | ||||

| 01 | Coding in Python |

Data types, CRUD operations If Else Statements & Loops Numpy, Pandas, Matplotlib Regression & Time Series in Python Monte Carlo Simulations in Python |

||

| 02 |

y = f(x) thinking (Excel + Python) |

Taylor Series Sensitivity based approaches Option Greeks |

||

| 03 |

Risk Metrics (Excel + Python) |

Formulating VaR & ES (Parametric, Historical, Monte Carlo) Calculation of VaR & ES for simple instruments (EQ, IR, Fx, Commodity) |

||

| Module 2 – Risk Aggregation | ||||

| 04 |

Portfolio Mapping (Excel + Python) |

Systematic VaR Specific VaR Factor Models & PCA |

||

| 05 |

Risk Mapping & Aggregation (Excel + Python) |

Bond Portfolio Stock Portfolio Option Portfolio |

||

| Module 3 – FRTB Model | ||||

| 06 |

Standardised Approach (Excel + Python) |

Delta, Vega, Curvature Charge Residual Risk add-on Default Risk Charge |

||

| 07 |

Advanced Approach (Excel + Python) |

Expected Shortfall Calibrations with stressed periods NMRF Stress Capital Default Risk Charge |

||

| 08 |

PnL Attribution & Backtesting (Excel + Python) |

PL Attribution Tests Backtesting |

||

| 09 |

Model Validation (Excel + Python) |

Common checks in model validation Review of SR 11-7 Case studies from past |

||

| Module 4 – Counterparty Credit Risk | ||||

| 10 |

Exposure Modelling (Excel + Python) |

EE, EPE, EEPE in Python Forwards (EQ, IR, Fx) Swaps (IRS, CCS) Options (EQ, Caplets) |

||

| 11 |

EAD Modelling (Excel + Python) |

Standardised Approach - CCR Internal Models Method |

||

| 12 |

CVA Capital Charge (Excel + Python) |

Standardised Approach Advanced Approach |

||

| 13 |

XVA toolbox (Excel + Python) |

End to end project in python calculating BCVA, FVA, ColVA, MVA, KVA |

||

Satya is an IIT and IIM alumni with 8+ years of total work experience spanning across Financial Risk consulting and project management and strategy. Worked as SME and Lead in Various finance, risk, regulatory engagements and complex data migraflon project. Adept in BASEL, FRTB capital calculations, model development and machine learning.

Ans 1. Anyone with finance/CA/CFA/FRM/Engineering Background can join this program. Basic knowledge of statistics is recommended but not compulsory

Ans 2. Market risk and counterparty capital charge program focuses on regulatory specific modelling and doesn't require advanced level of math's. Also the entire program is taught in Excel & Python to facilitate easy understanding of all models.

Ans 3. It is a 100% practical program with dozens of case studies, spreadsheet models & python codes. The approach of delivering the concepts is application based to make you a right fit for market risk consulting.

Ans 4. To get certificates you need to complete all topic wise assignments, final project and pass the MCQ based exam.

Ans 5. You can take either 1 year access or lifetime access. Please note that lifetime access is chargeable extra

Ans 6. With this website we have integrated a customized P2T player that will allow you to play encrypted classes. There are no limitations on the number of views. Also the software is compatible with Windows, Mac, Android or iPhone. We don't allow connecting multiple monitors to laptop.

Ans 7. To interact with the trainer we have a dedicated forum ‘D-forum’. Any questions asked on D-forum are expected to be replied within 24 hours by trainers and team of moderators & experts.

Ans 8. You can schedule your exams anytime after course completion but before the expiration of validity.

Ans 9. Every class is supported by one note files, excel sheet, python files and reading material. All these are available in the course section only.

Ans 10. Letter of Recommendation is virtually delivered within 60 days of passing the exam. LOR’s also mention the details of the final project completed to avail the certificate.